Ensure that the outsourcing partner provides timely and accurate reports related to compliance with financial regulations. If a service provider encounters challenges, having a predefined process for escalating issues ensures that they are addressed promptly and effectively. Companies should develop robust contingency plans to address potential disruptions caused by service provider issues.

Surviving the accounting busy season: an all-inclusive guide

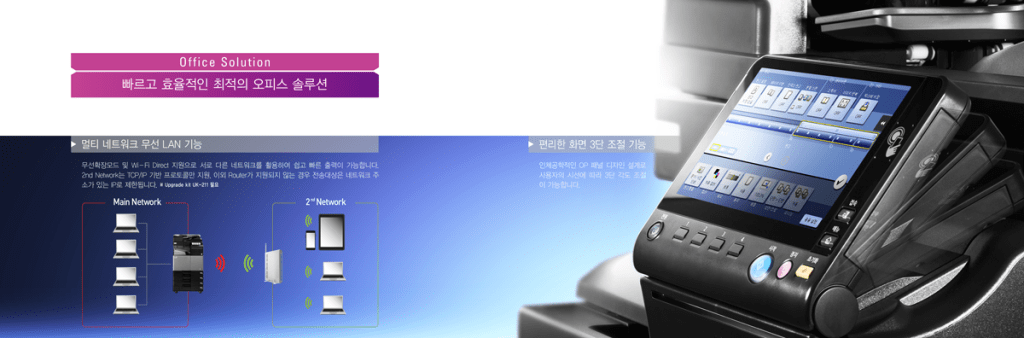

Clearly outline the roles and responsibilities of both the company and the outsourcing partner in the contract. This includes defining specific tasks, deliverables, and the timeline for implementation. By outsourcing IT functions, financial firms can access cutting-edge technologies and skilled professionals without the burden of maintaining and upgrading systems in-house. This strategic move not only enhances operational resilience but also supports scalability and innovation, enabling financial institutions to better serve their clients and respond swiftly to market changes.

Trial project

- As a result, many companies are now more willing to outsource complex financial functions.

- Examine case studies that detail challenges faced during outsourcing initiatives, extracting valuable lessons and best practices.

- Financial analysis isn’t in everyone’s skill set, so a good CFO is worth their weight in gold to ensure your cash flows stay healthy and you have the information you need when it’s time to make critical decisions.

- Evaluate risks related to communication breakdowns and cultural differences, especially when partnering with outsource accounting companies.

- As your outsourced team does not consist of in-house employees, you don’t need to worry about renting real estate or paying for utilities (electricity, internet connection, etc.).

Thanks to time zone differences, working with a global talent pool allows you to extend your company’s operational hours. Through effective management and communication, you can take advantage of the timezone disparity to massively boost the efficiency of your finance activities. A financial controller takes on a broad scope of responsibilities, from accounting and bookkeeping to other financial management tasks. Outsourcing this function in your financial management can help yield accurate financial reports and analyses of your financial state and give you access to strategic guidance to improve your finances.

How to manage your outsourced team efficiently

For instance, acknowledge when they manifested great effort or created quality outputs. So, when they underperform, you should let them know what they did wrong and guide them on ways to improve themselves. After all, staying on top of financial matters allows companies to create a budget plan for the future, evaluate business performance, and maximize assets and resources.

Wishup is the perfect solution if you’re looking for a dedicated virtual assistant to handle your bookkeeping needs. With a rigorous vetting process in place, Wishup ensures that you only get to work with the top 1% of the talent in the industry. Their virtual assistants are highly skilled, experienced, and capable of delivering exceptional bookkeeping services. Assess the potential for performance-related risks, such as delays, subpar quality, or failure to meet service level agreements. Ensure that the outsourcing partner has a robust understanding of relevant regulations and a track record of compliance. Implementing a continuous improvement mindset ensures that any identified issues are addressed promptly.

Factors to consider include the provider’s industry experience, their security infrastructure, and client feedback. This vetting process ensures that the chosen partner aligns with your business’s strategic objectives and values. Financial outsourcing, also called financial services outsourcing, is the act of sending some or all of the tasks overseen by your accounting department to an external agency. Often, these companies are overseas – think the Philippines or elsewhere in Asia – though outsourcing providers also exist within the borders of your own country (known as “onshore outsourcing”). For instance, insurance companies may need help with claims processing and policy management, while real estate agents may require accounts receivable and sales support solutions. Evaluate risks related to communication breakdowns and cultural differences, especially when partnering with outsource accounting companies.

Businesses have turned to finance outsourcing to benefit from cost-efficiency, better talent, and access to new technologies and systems. If you’re looking for location-specific platform to outsource financial service tailored to your needs, then responsibility center definition look no further than Freelancer.com. With professionals working in over 10 countries, it’s the go-to platform for connecting you with talented freelancers around the world.