This gives Ned the “value per pip” move with a 200 pip stop to stay within his risk comfort level. Ever since he blew out his first account, he has now sworn that he doesn’t want to risk more than 1% of his account per trade. Ned will only risk the usual 1% of his CHF 5,000 account or CHF 50. Ned, who we introduced in the previous lesson, is back in the U.S. Let’s say you want to buy EUR/GBP and your broker account is denominated in USD. Keep them small enough so that even when you lose, they don’t evoke any strong emotional response that could derail your trading.

In order to address it, one has to acknowledge that there is indeed a problem and that will make a trader realize that this mindset is flawed. With time and conscious effort, he will eventually realize that his trading positions don’t measure his worth as a trader. You are well on your way to becoming a profitable trader by calculating the correct position sizing.

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

- Today I have learned about pips and lot sizing in a quick and easy way, now and well equiped with account management.

- Let’s assume someone has $5,000 in a trading account and doesn’t wish to risk more than 1% on a trade.

- It goes beyond simply deciding how many lots or units to trade; rather, it involves calculating the appropriate percentage of your trading capital to commit to a specific trade.

- Forex traders often make the mistake of focusing solely on finding the perfect entries and exits.

- Some traders make the mistake of allocating 3% to a single trade, and then sling on close to 5 trades at once.

Therefore, professional and experienced traders what are stocks and how do they work pay closer watch to position sizing than anything else before opening a trade. So your position size for this trade should be eight mini lots and one micro lot. With this formula in mind along with the 1% rule, you’re well equipped to calculate the lot size and position on your forex trades. Forex trading is one of the most exciting and lucrative investment opportunities in the world.

Forex Position Size Calculator

At best, diversification tends to balance winners with losers, thus providing a mediocre gain. All we have to do to find the value in USD is invert the current exchange rate for EUR/USD and multiply by the amount of euros we wish to risk. Let’s say Ned is now chilling in the eurozone, decides to trade forex with a local broker, and deposits EUR 5,000. Ned didn’t fully understand the importance of position sizing and his account paid dearly for it. A long time ago, back when he was even more of a newbie than he is now, he blew out his account because he put on some x open hub and pfsoft enter technology alliance to deliver unique multi enormous positions.

Calculating Position Size

The goal of position sizing is to determine the optimal amount of capital to allocate to a trade based on the trader’s risk tolerance, goals, and market conditions. Position sizing refers to the process of determining the appropriate number of shares, contracts, or units to trade, based on your risk tolerance and the size of your trading account. Regardless of the trading strategy, position sizing is how to dump your broker and invest your own money crucial as it can greatly affect the number of profits one generates and losses incurred when things go south. Trade size position in forex refers to the number of units of an instrument one buys or sells. In the stock markets, people buy a given number of shares, which reflects the risk they take.

By following these steps, you can calculate your position size accurately based on your risk tolerance and account size. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

Stay ahead of the market!

This way even if some of your trades aren’t successful, you won’t lose all your money and will be able to keep trading. Lastly, we multiply the value per pip by a known unit/pip value ratio of EUR/USD. In this case, with 10k units (or one mini lot), each pip move is worth USD 1. Let’s figure how big his position size needs to be to stay within his risk comfort zone. A margin trading scenario that involves a losing trade using a broker with a Margin Call Level at 100% and no separate Stop Out Level. A margin trading scenario that involves a losing trade using a broker with a Margin Call Level at 100% and a Stop Out Level at 50%.

Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. For example, you might allocate 2% of your capital to each trade, which would limit your risk exposure while allowing you to participate in the potential upside.

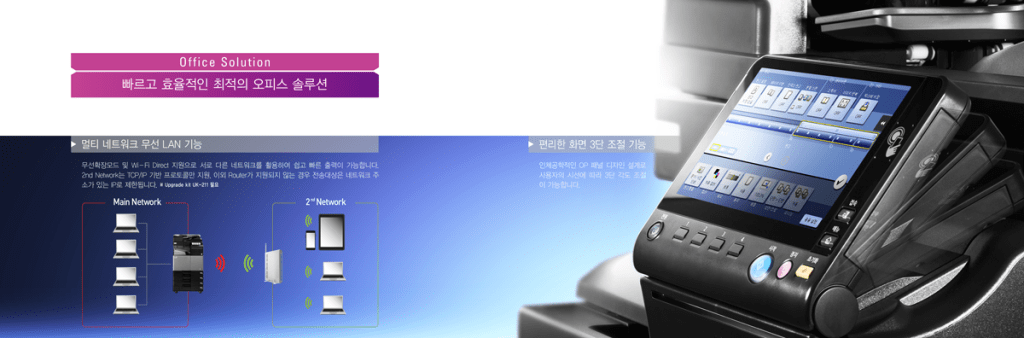

If you have a busy day of trading with several opportunities, you can setup a separate calculator for each symbol. Just press the “Add Symbol” button to add an additional calculator. Use the handle bar on the left side of the calculator to drag and re-arrange your calculators. Press the three dot menu on the right side of the calculator to remove it. We automatically update the relevant exchange rate between your account currency and the currency of the instrument.