By giving candidates real-life scenarios, you can assess how they approach and resolve financial challenges. This method helps in evaluating their analytical abilities and creativity in finding solutions. Assessing freelance accountants in this manner ensures that they can handle unexpected issues efficiently. This may mean specializing in payroll and supporting businesses through their payroll year end checklist. Or, it could mean becoming an expert in tax compliance and ensuring your clients file their taxes correctly. There are plenty of areas to choose from, so you can find your niche and specialize in what excites you.

Freelancing Skills You Need to Update Regularly

Questions such as “Can you describe your experience with financial software?” or “How do you ensure accuracy in your financial reports?” can https://www.bookstime.com/ provide valuable information. These questions help in understanding the candidate’s practical skills and reliability in handling financial tasks. Increased revenue streams, more extensive inventory management, and greater transaction volumes require more sophisticated financial oversight. Hiring a freelance accountant during this growth phase ensures that your financial systems can handle the increased demands effectively. This proactive approach not only safeguards your financial stability but also supports informed decision-making, enabling your business to scale sustainably.

- When reviewing potential candidates, focus on their qualifications and credentials.

- We check all comments within 48 hours to make sure they’re from real users like you.

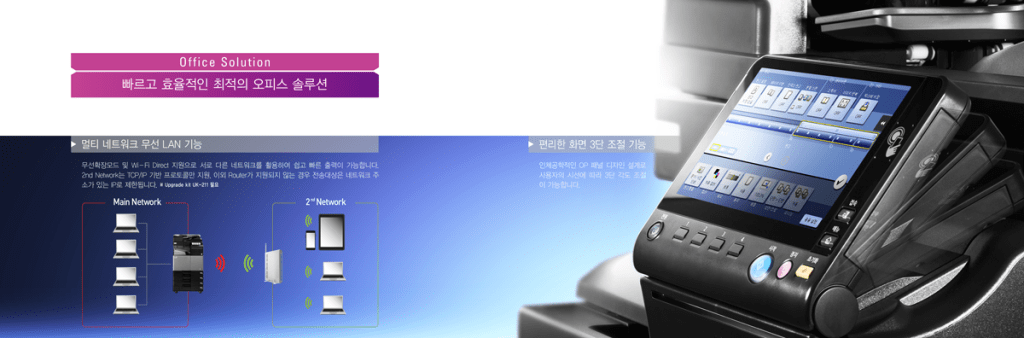

- In today’s digital age, accountants must be proficient in accounting software and other financial tools.

- For larger companies who have more specific needs when it comes to bookkeeping, we recommend a more exclusive and selective site like Toptal or UpStack.

- Mediation or seeking advice from a professional organization can also help resolve disputes amicably.

- If you have a larger budget and want a senior-level accountant to handle more tasks for a longer period, try Toptal or UpStack.

Accountingfly

Intuit QuickBooks Self-Employed ($15 per month) is a good choice for a self-employed individual or freelancer who needs to separate business and personal expenses, send invoices, and track mileage. It also has useful mobile apps and helps you estimate your quarterly taxes based on your income and expenses. As I mentioned earlier, it can also track your mileage, using your phone’s location services. The needs of freelancers, contractors, and sole proprietors vary as widely as the types of businesses they represent. Consider the factors below before you choose an accounting service for your business.

Evaluate communication skills

Accountants prepare financial freelance accountant statements, summarizing the financial position and performance of the business. These statements, including the balance sheet, income statement, and cash flow statement, are essential for both internal and external stakeholders. We provide advice and reviews to help you choose the best people and tools to grow your business.

Mileage Tracking

- One of the best ways to improve your cash flow is to accept debit and credit cards and direct bank payments, so that customers can pay instantly and conveniently—though extra processing fees apply.

- Leverage the goodwill you’ve built up from automating their basic accounting by offering to do the same with their payroll.

- When you choose to Pangea match freelance accountants, you gain access to a curated pool of highly qualified professionals.

- Hiring an accountant is a pivotal decision for any business, irrespective of its size.

- How much you charge will depend on your skills and the type of clients you’re working for.

- Understanding these key indicators can help you determine how to hire a freelance accountant effectively when the need arises.

- Your accountant should be able to explain complex financial concepts in a clear and understandable manner.

A strong internet connection is essential, as is software for time tracking and workflow management, invoicing tools, and a payment processor. Don’t forget about insurance — consider professional indemnity, public liability, cyber, and contents insurance. An affinity with numbers is obviously the main requirement for a freelance accounting career, but the more qualifications you have, the more marketable you become. Although freelance accountants in the U.S. are not required by law to have any specific credentials, it’s worth getting a CPA (certified public accountant) qualification. After you get a few retained earnings retainer clients onboard, think about how you can sell them more services.